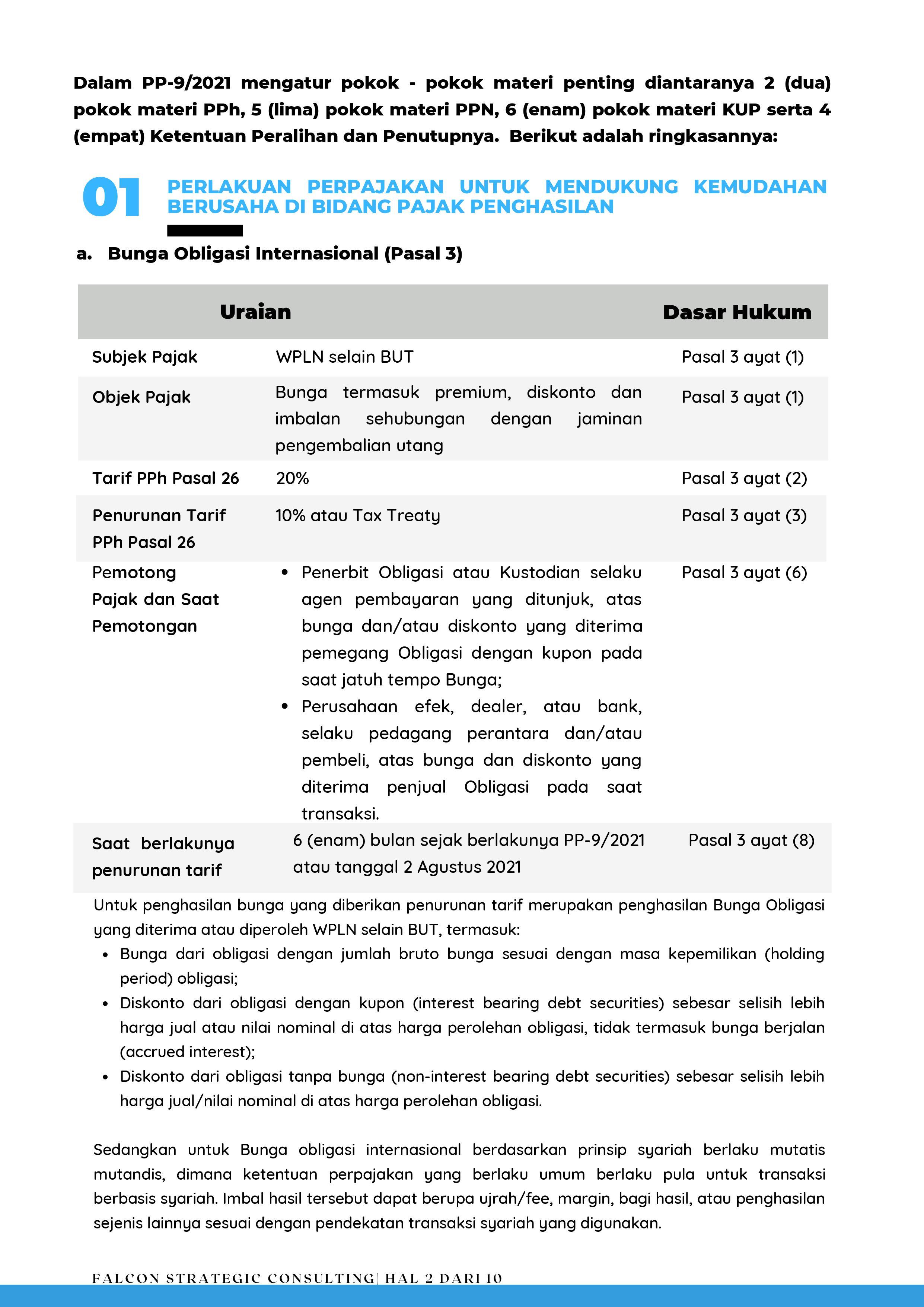

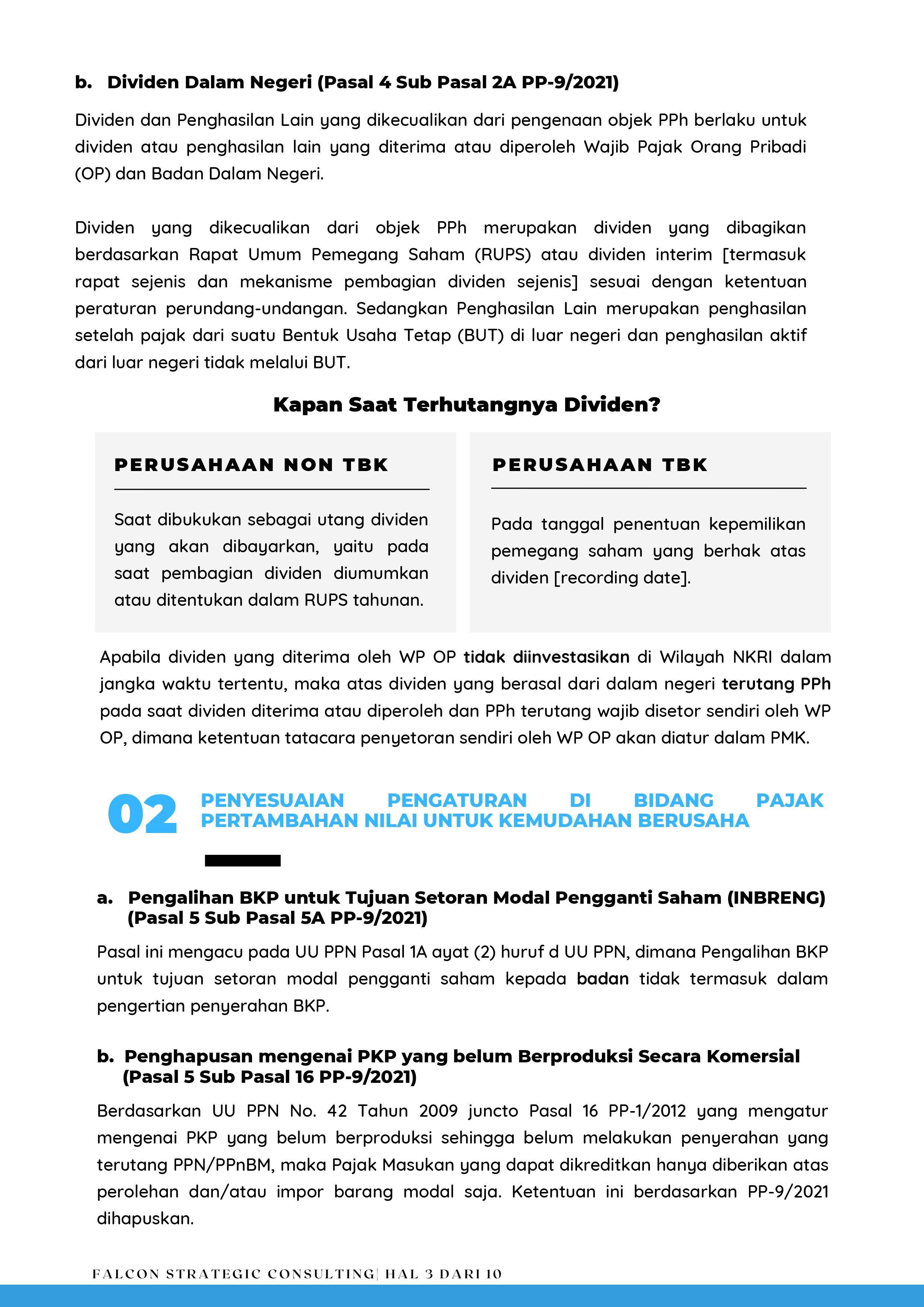

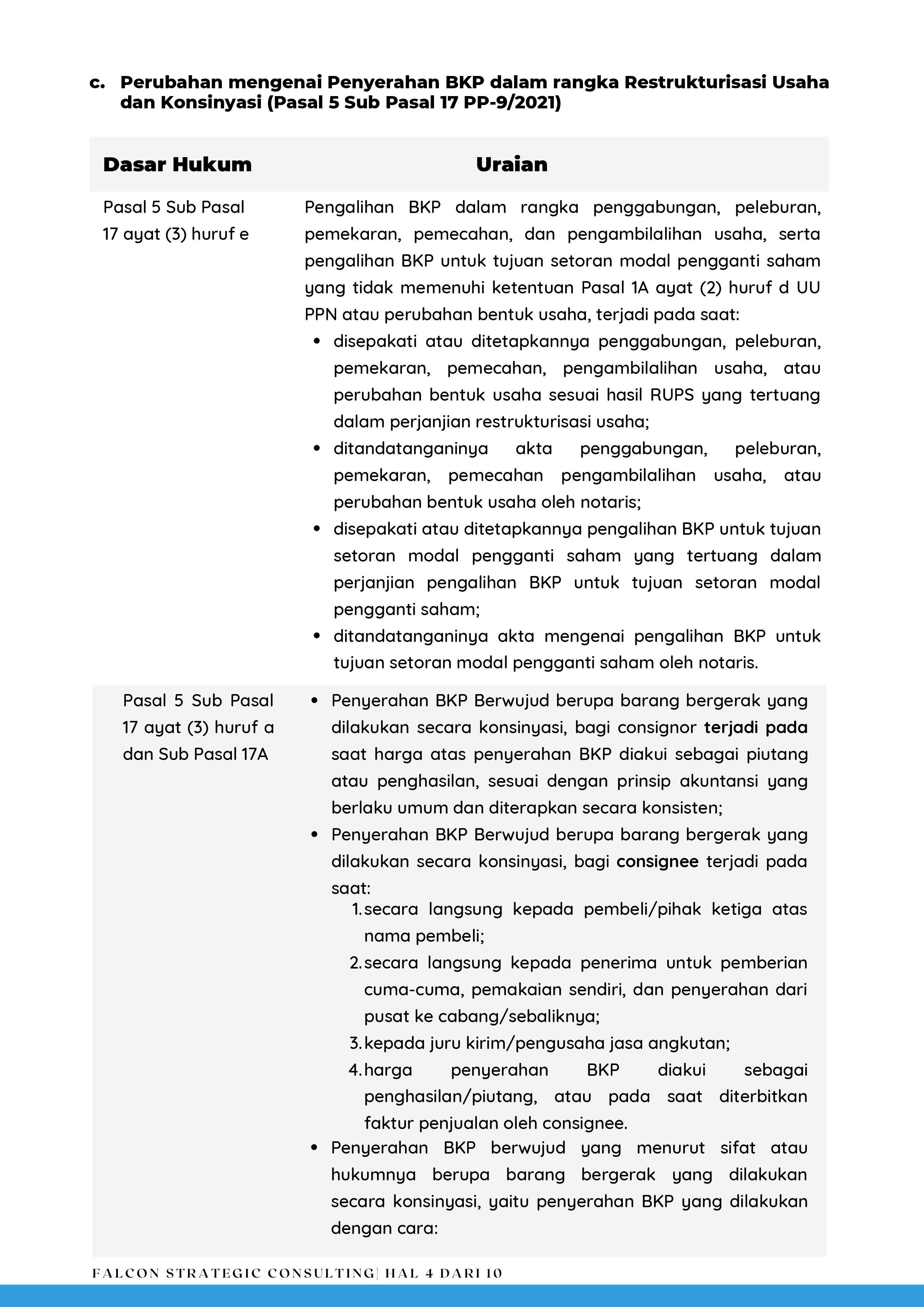

Perlakuan Perpajakan untuk Mendukung Kemudahan Berusaha

NEW FINAL INCOME TAX REGULATION FOR SMALL MEDIUM ENTERPRISESGovernment of Indonesia has recently issued its regulation No. 23 Year 2018 (“GR 23/2018” or “the Regulation”) on June 8th, 2018 concerning Income Tax on Income from businesses received or earned by taxpayers having certain gross turnover. This regulation will be effective on 1 July 2018. The…

100% EXEMPTION ON DUTY ON TRANSFER OF LAND AND BUILDING RIGHTS DUE TO SALE AND PURCHASE OR GRANTING THE FIRST RIGHT AND/OR 0% TAX IMPOSED ON DUTY ON TRANSFER OF LAND AND BUILDING RIGHTS DUE TO INHERITANCE OR GRANTS WITH MAXIMUM TAX OBJECT SALE VALUE OF RP 2 BILLIONS Governor delegate his authority to grant…

FISCAL TREATMENT FOR TAXPAYER AND TAXABLE ENTREPRENEUR WHO USE PARTICULAR COLLECTIVE INVESTMENT CONTRACT SCHEME RELATING TO FINANCIAL SECTOR DEEPENING For income tax purposes, special purpose company (SPC) in particular collective investment contract (KIK) scheme will be considered as one unit with its KIK. Particular KIK scheme is real estate investment trust (DIRE) with or without…