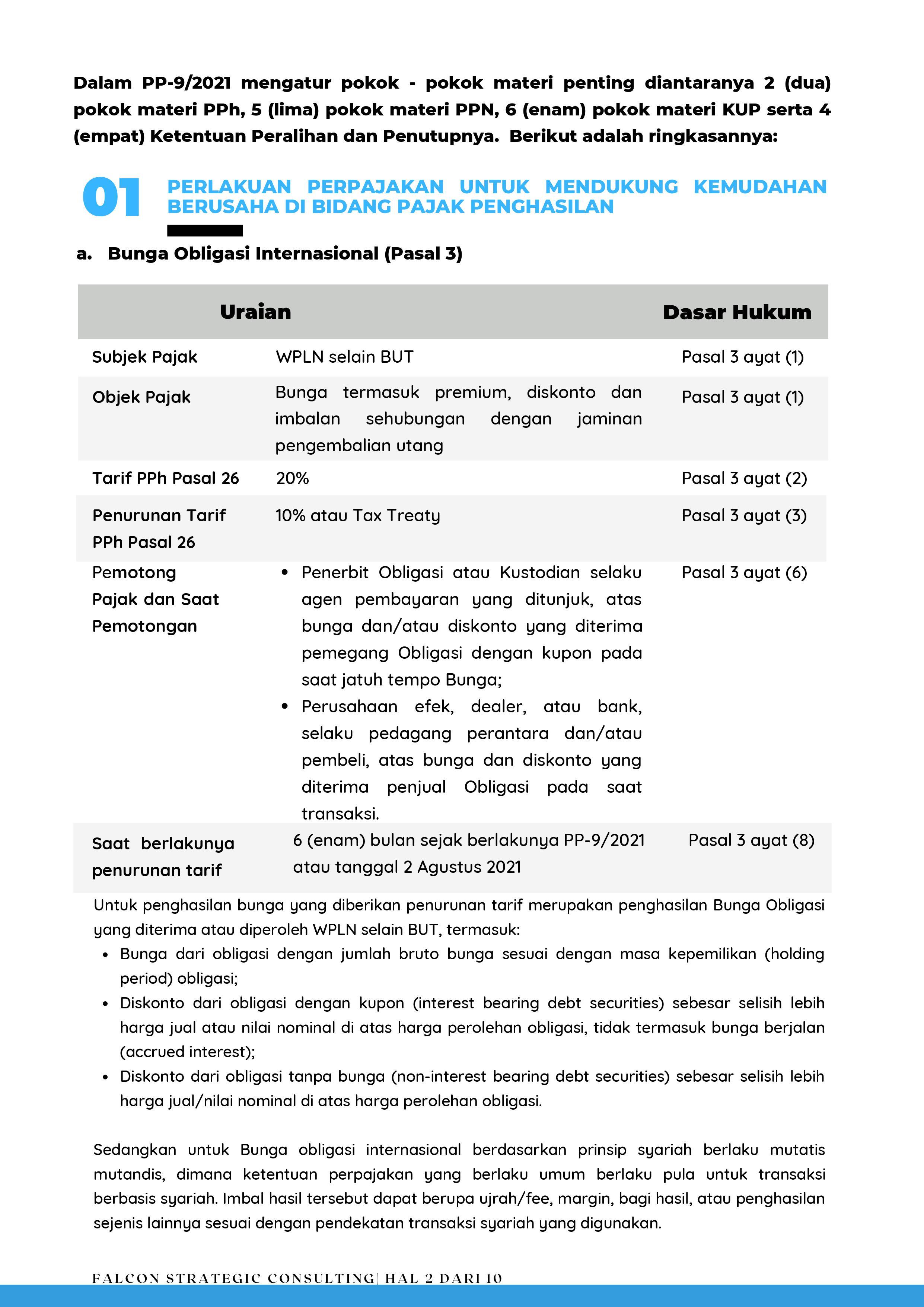

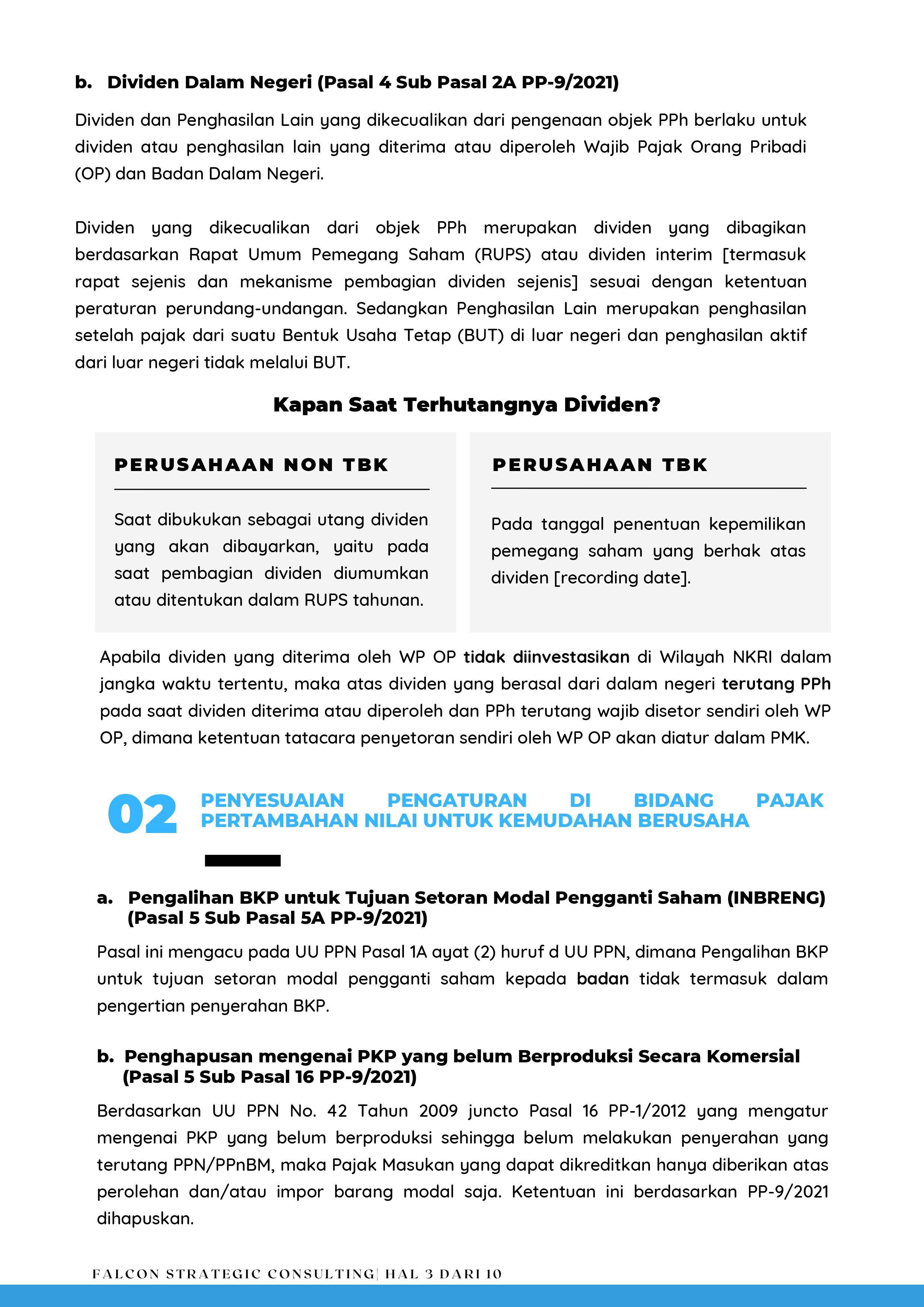

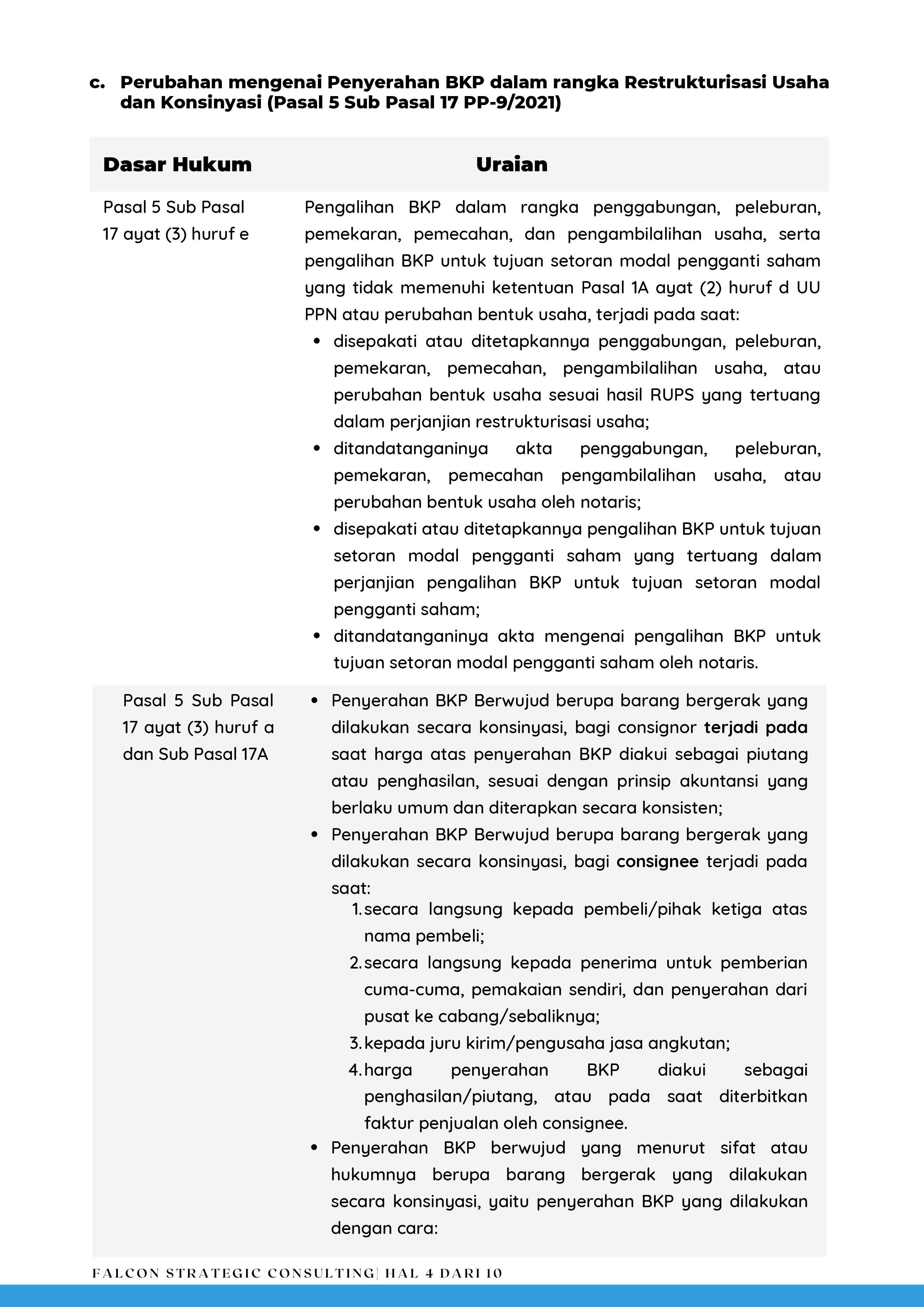

Perlakuan Perpajakan untuk Mendukung Kemudahan Berusaha

REVOCATION OF CIRCULAR LETTER NO. SE-09/PJ.42/1997 CONCERNING INCOME TAX TREATMENT FOR LIFE INSURANCE BENEFITS (GENERAL INOME TAX SERIAL NO. 47) Confirmation in DGT Circular Letter No. SE-09/PJ.42/1997 concerning Income Tax treatment for life insurance benefits which stated excess of saving benefits over premium paid will be considered equally as revenue from interest on saving account…

ELECTRONIC TAX INVOICE (e-INVOICE) Regarding implementation of electronic tax invoice (e-invoice), DGT announce the following: 1. Stipulation regarding e-invoice which already issued: a. Minister of Finance Regulation No.151/PMK.03/2013 concerning procedures for preparing and correcting or replacing tax invoice; b. DGT Regulation No. PER-16/PJ/2015 concerning procedures for preparing and reporting electronic tax invoice; c. DGT Regulation No. PER-24/PJ/2012 concerning form,…

VAT TREATMENT ON PARTICULAR PORT SERVICE DELIVERY FOR SEA TRANSPORT COMPANY WHICH CARRY OUT OVERSEAS SEA TRANSPORT Particular port service delivery by port management corporation to sea transport company which carry out overseas sea transport will be exempted from VAT. Such VAT exemption will be valid under following term and condition: For ship operated by…

AMENDMENT ON MINISTER OF FINANCE REGULATION NO. 191/PMK.010/2015 CONCERNING FIXED ASSETS REVALUATION FOR FISCAL PURPOSES FOR APPLICATION SUBMITTED ON 2015 AND 2016 This amendment refers to revaluation of fixed assets with following condition: Fixed assets should be located in Indonesia and have useful life more than 1 year. Approved fixed assets revaluation under this regulation…

ACCESS OF FINANCIAL INFORMATION FOR TAX PURPOSES Access of financial information are access to receive and obtain financial information in order to implement taxation provision and international tax agreement.DGT has the authority to get such access from financial service institution engage in banking, capital market, insurance, other financial services institution and/or other entity classified as…