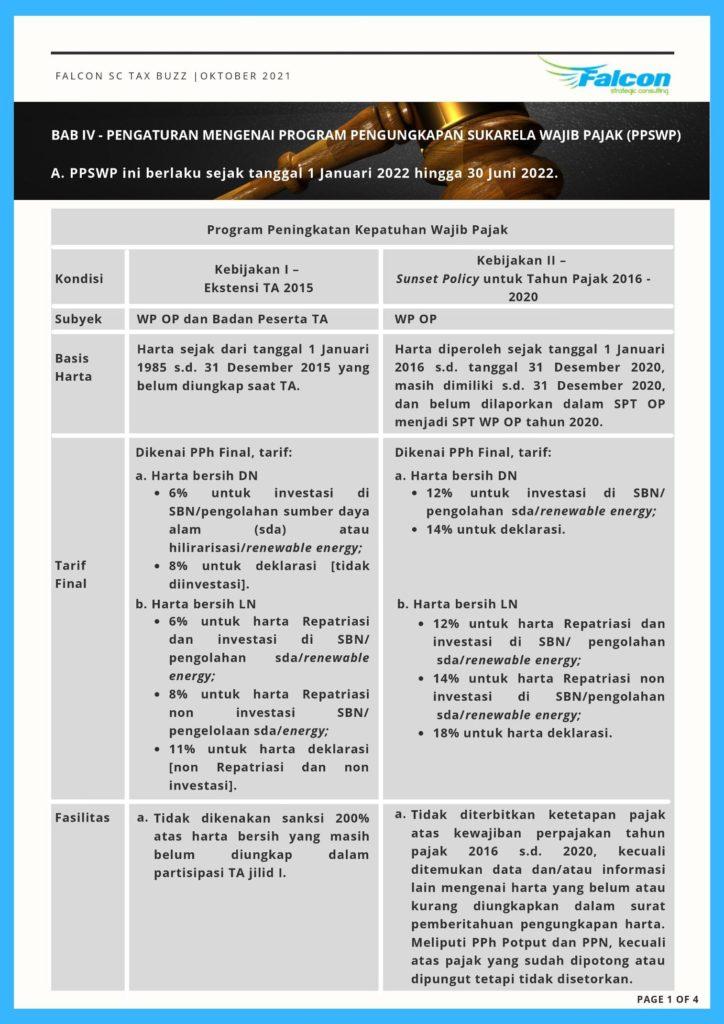

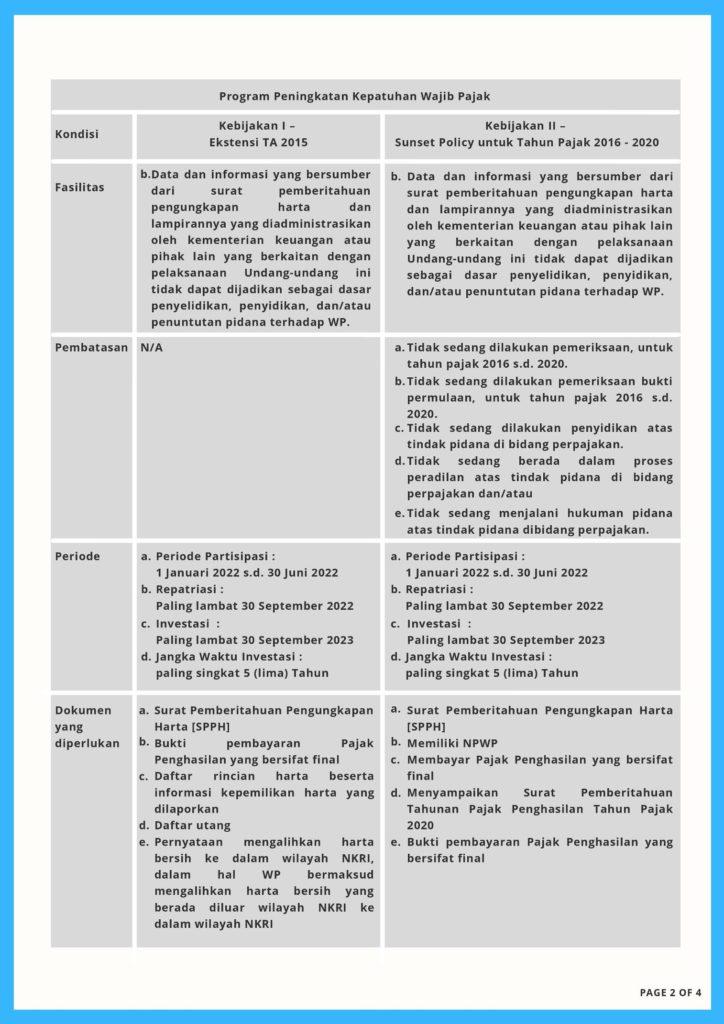

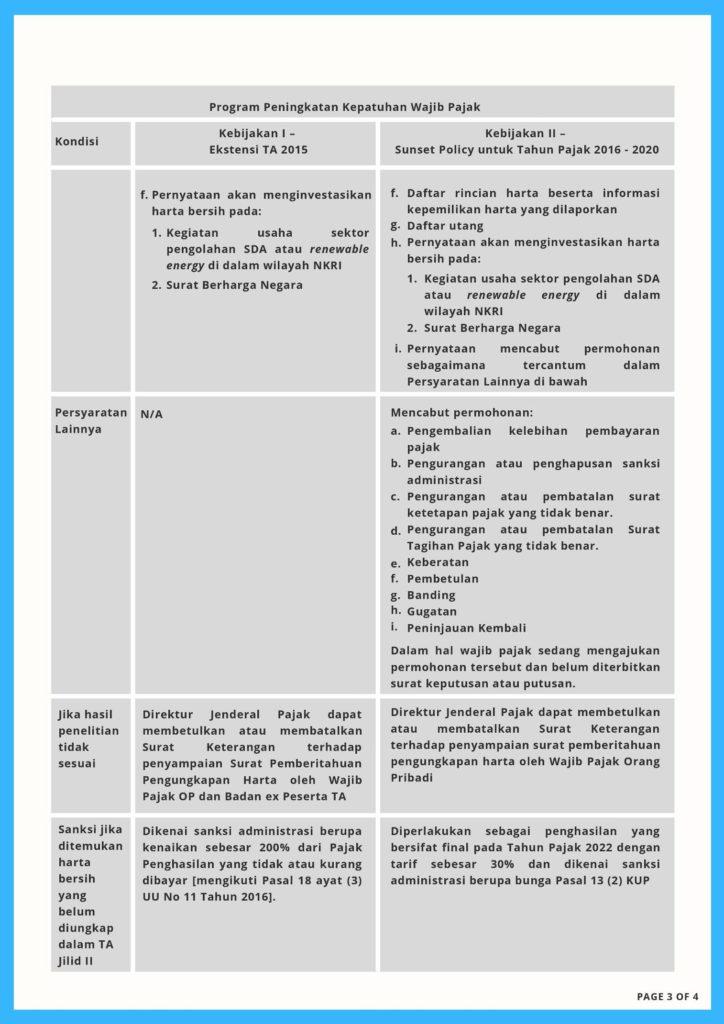

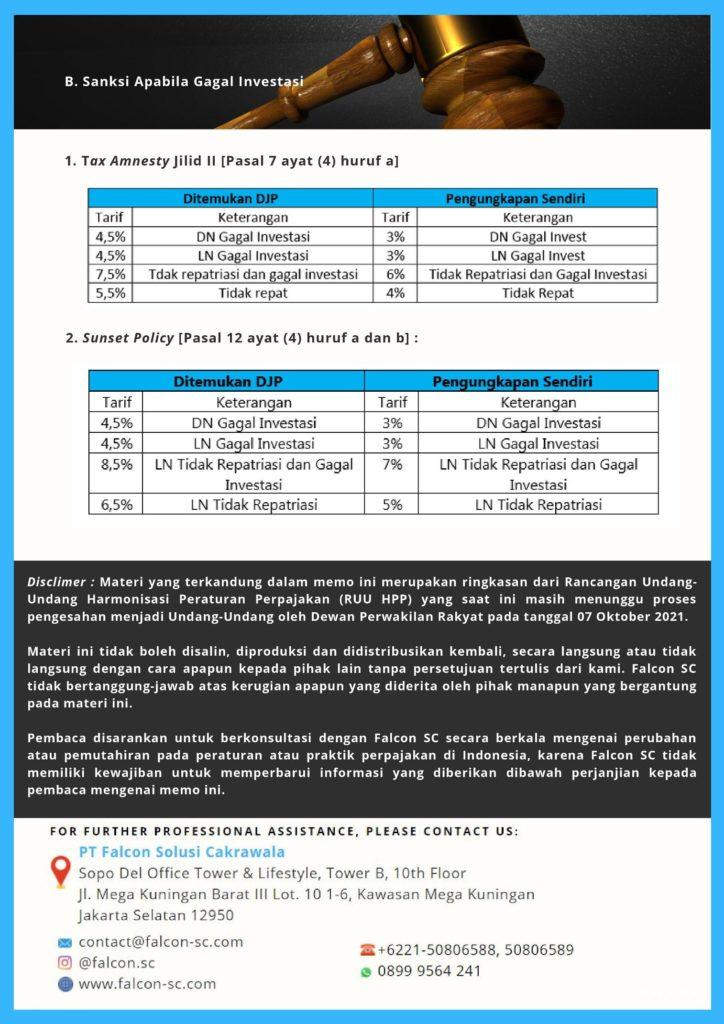

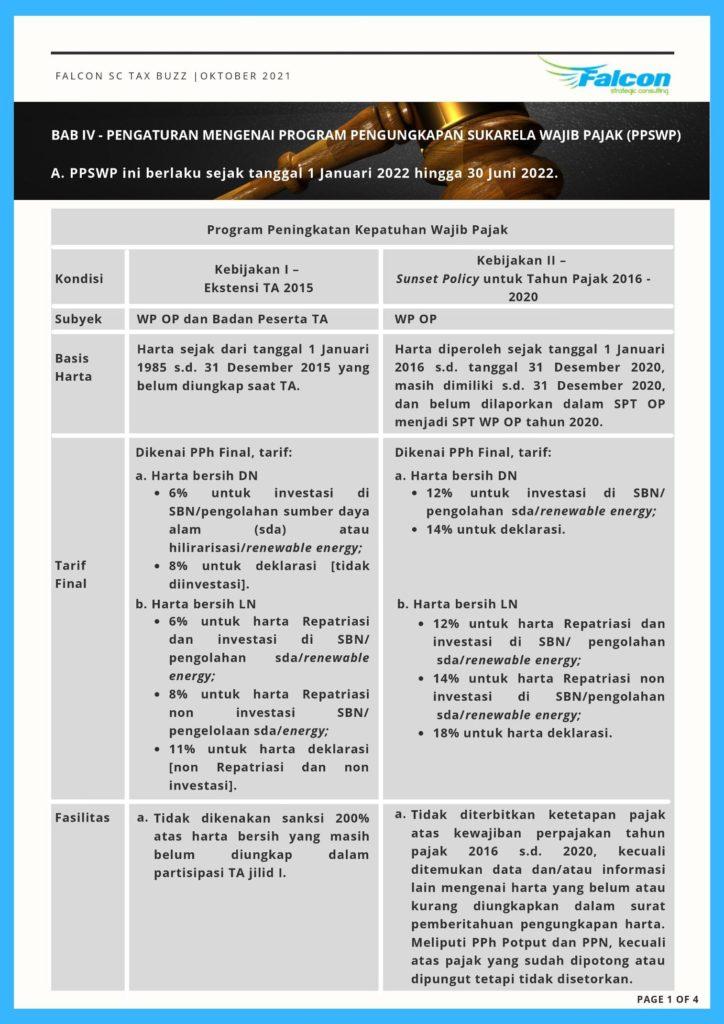

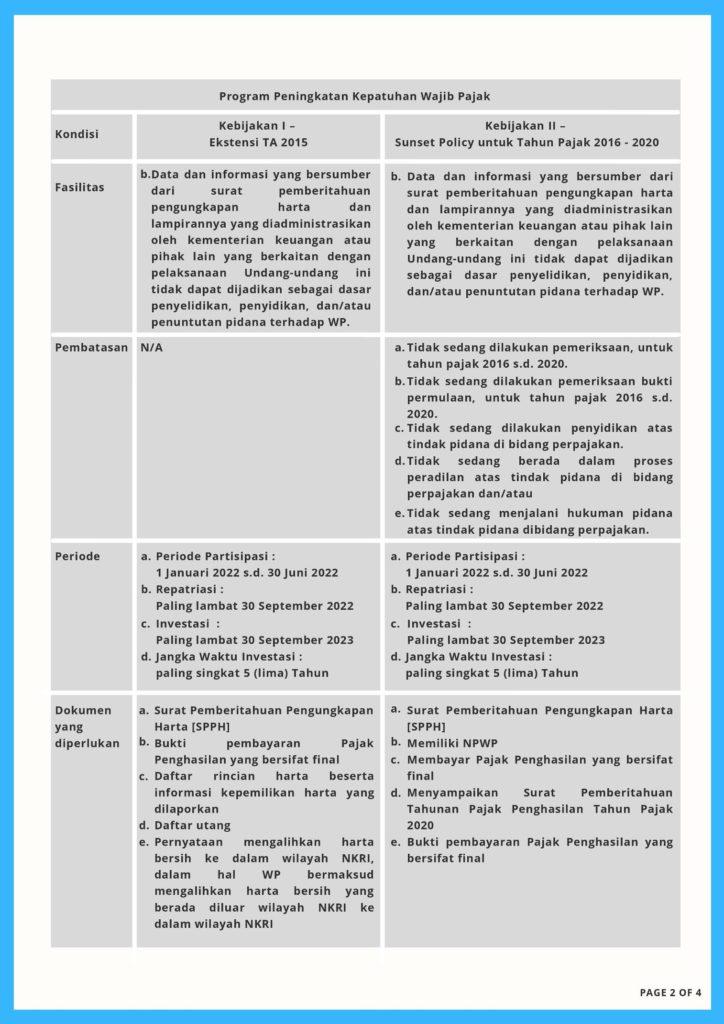

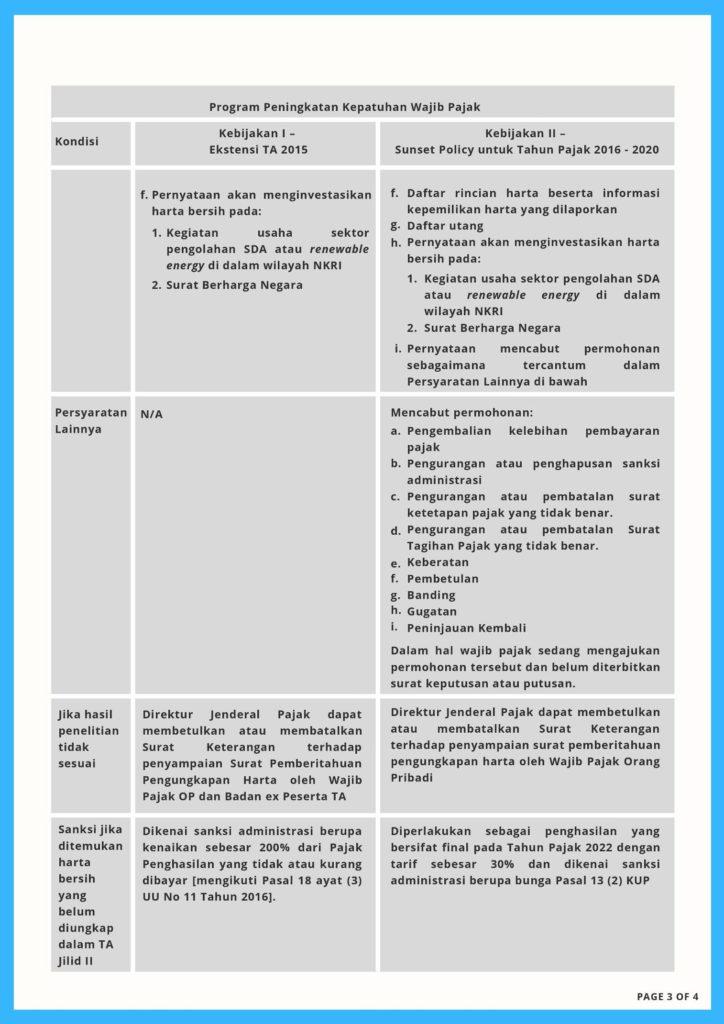

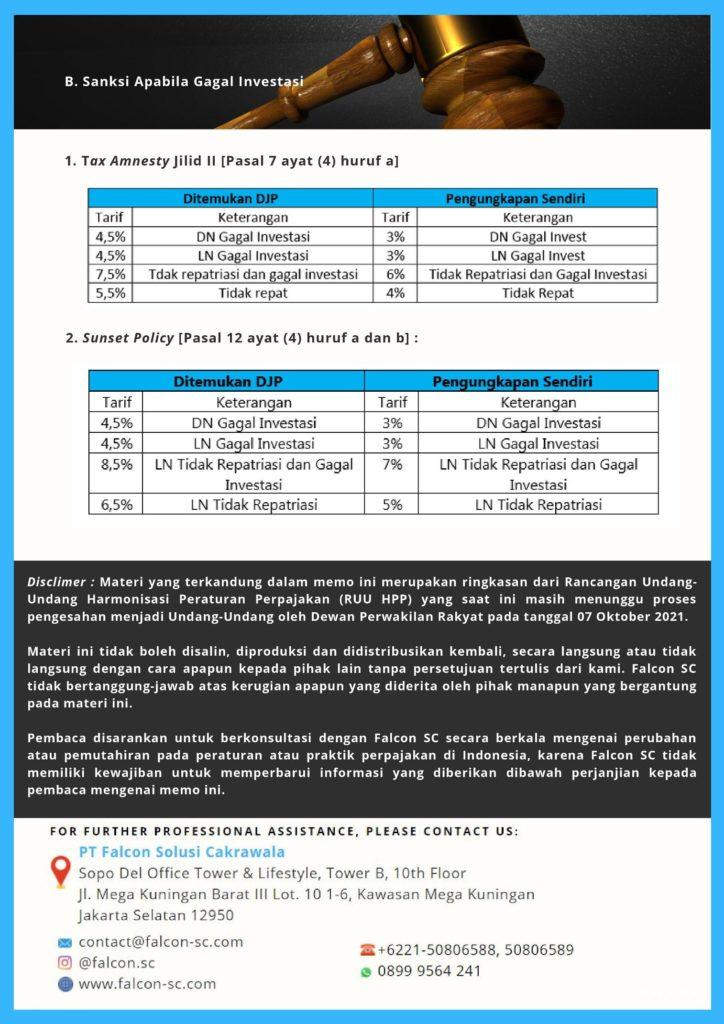

Pengaturan PPSW Dalam RUU HPP

I n a c c o r d a n c e w i t h P M K – 2 1 3 a n d P E R – 2 9 Following the release of Country-by-Country Report (“CbCR”) requirements in early 2017 through Minister of Finance (“MoF”) Regulation No. 213/PMK.03/2016 (“PMK-213”), The Directorate General…

STIPULATION OF DEBT AND EQUITY RATIO FOR INCOME TAX CALCULATION PURPOSES Article 1 For income tax calculation purposes it is set a debt to equity ratio for corporate taxpayer which is established or domiciled in Indonesia and whose capital divided into stocks. Debt is average outstanding of debt within one fiscal year or part of…

FISCAL TREATMENT FOR TAXPAYER AND TAXABLE ENTREPRENEUR WHO USE PARTICULAR COLLECTIVE INVESTMENT CONTRACT SCHEME RELATING TO FINANCIAL SECTOR DEEPENING For income tax purposes, special purpose company (SPC) in particular collective investment contract (KIK) scheme will be considered as one unit with its KIK. Particular KIK scheme is real estate investment trust (DIRE) with or without…

FORM, CONTENT AND PROCEDURES FOR FILLING AND SUBMITTING VAT PERIODIC TAX RETURN VAT periodic tax return subsequently will be mentioned as periodic VAT return 1111 consist of: a. Master form 1111 and b. Attachment which consist of: 1. Form 111AB – summary of delivery and acquisition 2. Form 1111 A1 – list of exported tangible taxable goods (BKP), intangible taxable goods…